Dutch developer VoltH2 has signed a heads of terms agreement to sell green hydrogen from its proposed 50MW plant in the Netherlands to German chemicals producer Evonik, to replace the use of polluting fossil-based H2 in hydrogen peroxide (H2O2) production.

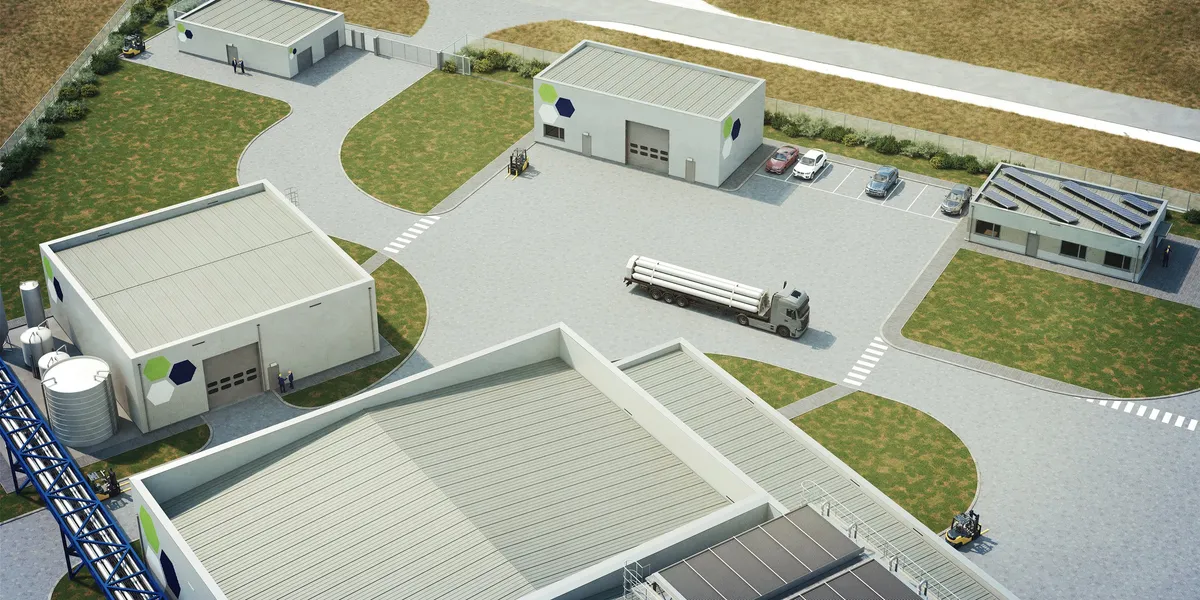

Under the terms of the non-binding agreement, VoltH2 will build its plant near Evonik’s existing facility in the port city of Delfzijl in the northern Netherlands, with a view to beginning supply when the project comes on line in late 2027.

Hydrogen peroxide is used primarily as a bleaching agent in the production of wood pulp and paper, as a cleansing agent in manufacturing processes, and as a major input chemical in the production of detergents. It requires significant volumes of hydrogen, as well as power and steam.

Evonik said it plans to source a “significant portion” of its total hydrogen demand for the Delfzijl plant from the VoltH2 electrolyser, and in the short term will make up the difference with grey H2 produced on-site with unabated fossil gas.

“This solution will ensure uninterrupted supply until green hydrogen capacity grows to fully cover demand at all times,” the company said in a statement.

“We want to switch our production over entirely to renewable resources,” said Peter Metten, managing director of Evonik’s Peroxide Netherlands division. “By introducing green hydrogen at the Delfzijl plant, we are taking a significant step toward this goal.

“Finding sustainable solutions for [electricity and steam] is more straightforward. Sourcing green hydrogen is the tricky part. Fortunately, we have found in VoltH2 a partner that has the local resources, technical know-how, and vision to optimally collaborate on a cleaner, greener industry.”

“We expect up to half our hydrogen demand for H2O2 production at Delfzijl to be covered by VoltH2’s electrolyser,” a spokesperson for Evonik told Hydrogen Insight. “And we do indeed aim to eventually raise this proportion to cover all our hydrogen needs. Building this capacity will be a team effort over the next several years, however, and will include establishing a solid, widespread hydrogen network in the region –- something we aim to achieve with this collaboration.”

Any green hydrogen not used by Evonik would be distributed to other customers of VoltH2, which plans to install an on-site dispenser for loading tube trailers, which would be used to deliver hydrogen elsewhere.

Delfzijl hosts a major industrial estate with many users of hydrogen — in fact, the site was the subject of a recent scientific study of hydrogen emissions published in the journal Nature.

The deal between Evonik and VoltH2 is non-binding, but nevertheless brings the proposed 50MW project closer to realisation.

Green hydrogen projects that have offtakers lined up — especially credible industrial customers with existing hydrogen demand — are far more likely to secure the financing they need to proceed.

If built, the VoltH2 Delfzijl project would exceed the capacity of Europe’s largest green hydrogen plant in operation today — the 24MW electrolyser operated by Yara in Norway — however, by 2027 it is likely to have been usurped many times over by the expected commissioning of Shell’s 200MW Holland Hydrogen 1 project in the Netherlands, and Stegra’s 700MW installation for green steel production in Sweden.